The Center for Budget and Policy Priorities (CBPP) invites rural organizations to sign-on to a letter urging policymakers to permanently extend the Earned Income Tax Credit (EITC).

If your organization would like to sign this letter created by the Center on Budget and Policy Priorities, please read the attached letter and contact Ellen Nissenbaum by 12:00PM EST, Wednesday, July 8. Please specify exactly which organization should be listed on the letter of support.

EITC and Rural America

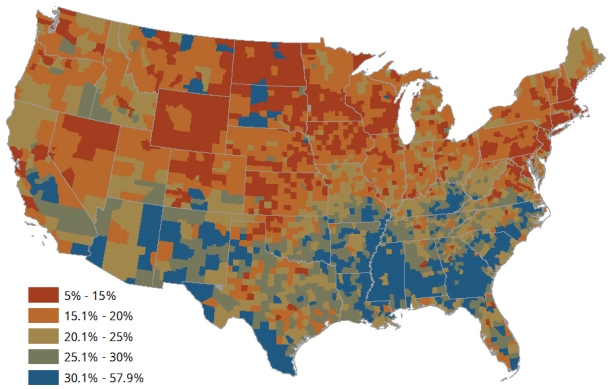

A recent White House report on rural child poverty identified the Earned Income Tax Credit (EITC) is a critical poverty-fighting tax benefit, functioning as a social safety net that rewards working people and families.

Rural Americans in particular depend upon the EITC to kick-start families in their economic success. A recent study conducted by the Center for Rural Affairs found that a higher percentage of individuals that filed for income tax returns in rural areas claimed the EITC compared to urban areas. On average, the percentage of those claiming the EITC in rural areas exceeded those claiming the tax credit in urban areas by 2.7%.

Percent of Tax Returns Claiming EITC

*Data collected and Report conducted by the RuFES Action Network*

Additionally, the Center for Policy Priorities is holding a webinar on Friday, July 10 at 11:00AM EST to discuss the latest legislative outlook regarding the Earned Income Tax Credit. Register here.